THE PROBLEM

What free digital experience

will leverage planning engagement to drive NNA for digital investors?

We were tasked with exploring a free digital experience that will maximize planning engagement for digital investors. Research showed that clients with a financial plan feel more confident about their financial future. Financial plans serve to generate next best actions for clients that take them towards their financial goals while utilizing Schwab products and service, with potential to drive Net New Assets (NNA).

Provide recommendation

THE GOALS

What does success look like?

If successful project, can we provide recommendation for

which team should take this on?

Give the client the full and dynamic picture of their financial health.

Drive financial client outcomes

How can we promote financial awareness, education and healthier outcomes?

THE RESEARCH

After speaking with several financial planners, we knew we needed these three things:

THE RESEARCH

Improve client satisfaction

How can we create an experience that customers will

Engage clients on their own terms and in their own devices.

Goal-driven investors

Increase planning penetration

How can we penetrate across all channels (mobile, schwab.com, audio assistance, etc.)

What client jobs are we solving for?

As a client, "I want to make sure I get answers to my immediate financial questions, and to further understand the value of taking actions towards my financial goals, even if as those goals evolve." Our clients are these type of investor:

Disengaged saver and investors

Tech-savvy investors

THE RESEARCH

THE RESEARCH

A concept that uses an animal or plant as a metaphor/representation of your finances.

Minimize initial time to value and provide ongoing value with personalized insights.

Advisor-guided investors

MoneyGuide Pro not doing the job for our clients

After speaking with our colleagues (6 subject matter experts in planning and open account space), we determined that we needed more information about what it is about planning that drives positive outcomes. We looked at the current financial planning experience MoneyGuide Pro (MGP) and started interviewing clients to understand how and why they used this product.We also asked customers how their order was and only collected data on the meh through hated it comments.

THE RESEARCH

How can we turn anxiety into confidence?

The team developed 14 hypotheses to determine a perspective of what our clients need today and in the future. These hypotheses were derived from previous research and findings from other Schwab teams. We reached out to our clients to see if our hypotheses were accurate and to provide responses on other questions we had. We learned from client feedback and interviews that our clients are "anxious when planning for their financial future". Next we synthesized our client feedback and brainstormed ideas.

How are learning habits formed?

We dove deeper to understand where our clients had the most stress and anxiety in planning for a life event or starting and maintaining a new habit. We conducted a survey with 50 participants. We asked our participants, "what new habit have you recently started?" "What research did you do prior to starting your new habit?" "Did you reach your end goal?"

Here are our findings:

Most participants did not know where to start, where to research and felt upset about wanting to change their current habits (losing weight, stop smoking, sleep more, etc)

Participants were most happy and less stressed once they have made a decision to change current habit or start new habit, creating a game plan, motivation to continue making the change (once making it over initial hump) and reaching outcome or goal

Participants felt unhappy and anxious around doing the research and starting off with those first days and weeks to follow game plan. These were the areas of most drop off for participants. They didn't have those initial "rewards" to stay motivated to continue.

OPPORTUNITY & IDEATION

We created 5 concepts based on our findings

After getting the survey results back, we found out that no single concept stood out as head and shoulders above the rest. We saw that My Roadmap concept and MGP scored the highest amongst the rest. We then went back to the concept board to see how much further we could push each concept. We decided to use My roadmap as a test as it resonated a little more than the rest.

DigitPet

Concierge

A complimentary digital concierge that guides you through making your plan and assists you along the way.

BUILD & IMPLEMENTATION

12 weeks

THE RESULTS

Business impact

DURATION OF PROJECT FROM INCEPTION TO RECOMMENDATION

A FEW DESKTOP DESIGNS

Finances with friends

A tool that helps you stay accountable and have more fun, but allowing you to create financial goals with a friend.

Here are a our final key learnings

Keep it simple: Our clients appreciated not cognitively overloading them with content. It is important to keep the design simple because it is easier to process in the brain. Less is always more.

Consistency across the omni-channel experience: Our goal is to create a seamless experience across all devices. Make sure this is done without the client knowing about it.

Navigation should be simple and intuitive: Learnability of our design is key for its success. Our clients should intuitively be able to navigate through our app via clear pathways and be able to complete all primary tasks without requiring any explanations.

Minimize data input: If you know what the form fields should say due to the information that was previously collected, make sure to autofill the forms. Our goal is to have our clients do less work, but earn more in the end.

A “lighter” planning experience can provide great outcomes: Setting up even one goal will provide value—and once clients see the value, they are motivated to do more.

Build product

WE RECOMMENDED THAT THE SCHWAB INVESTMENT TEAM TAKE ON THIS PROJECT

Financial challenge

40-day challenges for you to complete one small step to improve your total financial life.

80

FINAL NET PROMOTER SCORE

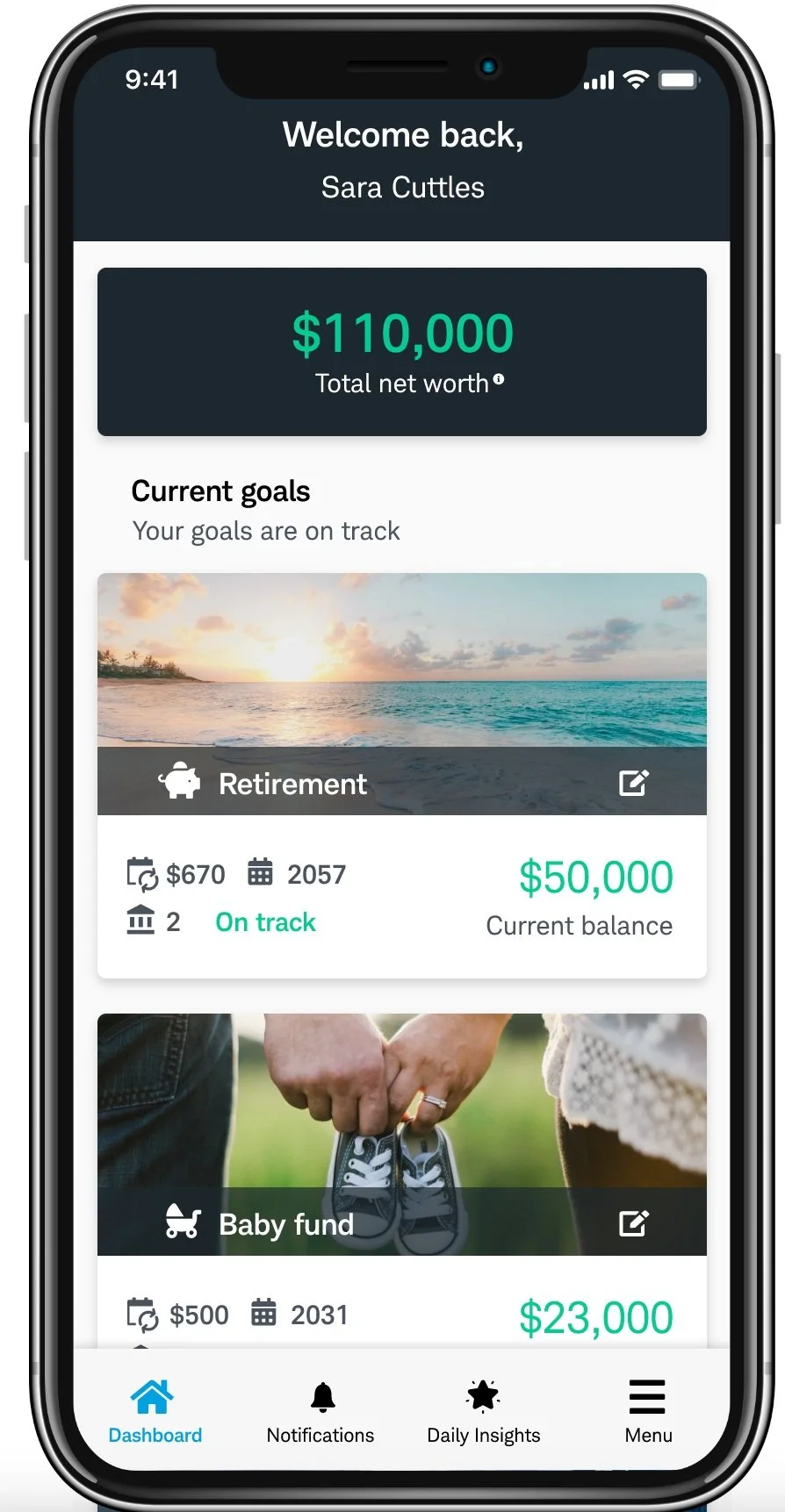

My roadmap

A digital tool that allows you to see your financial landscape, and helps you uncover new opportunities for how to arrive to goals efficiently.

100%

FINAL EASY SCORE